Table of Contents

Upcoming Batches of Bitcoin Specialist Course :-

| Batch | Mode | Price | To Enrol |

|---|---|---|---|

| Starts Every Week | Live Virtual Classroom | 7500 | ENROLL NOW |

Different people interpret Bitcoin differently as per their understanding. Some describe it as the future of money and some as a speculative bubble that could go kaput any time. Mystery shrouds Bitcoin the internet platform for money even today

Before we understand how and why the value of Bitcoin be touching millions soon. And the same shall lead to an increase in Bitcoin millionaires. We need to understand what Bitcoin is all about. For a complete understanding of Bitcoin and the changes that it would usher in for our world requires a lifetime. So let us examine Bitcoin through the lenses of its historical fundamentals, technical underpinnings, and financial asset status.

Bitcoin is mostly about anonymous transactions and I don’t think that over time it is a good way to go. I am a huge believer of Digital currency but doing it on an anonymous basis, I think that leads to some abuses, so I am not involved in Bitcoin

Bill Gates on Bitcoin

Confused don’t be, lets get on with our pursuit of understanding the Bitcoin world.

Bitcoin is the most noteworthy triple entry bookkeeping system in today’s world. From a user’s perspective, it resembles cash for the internet. Bitcoin is a unanimous network that powers a new payment system and true digital money in nature. No central authority or middlemen governs this first-ever decentralized peer-to-peer payment network powered by its users alone.

Check Henry Harvin Reviews:

How Does Bitcoin Work?

“Bitcoin is a techno tour de force.”

Bill Gates

Bitcoin falls into the electronic cash category. But other digital forms of money have a central party, bank or payment processor to govern its working and movement. Bitcoin, on the other hand, has its network of users alone to maintain it. It’s a no restriction network. Anyone can become a user by downloading a piece of open-source software on their computer and connect to the Bitcoin network through Internet

Users connected to the network can transact with each other.

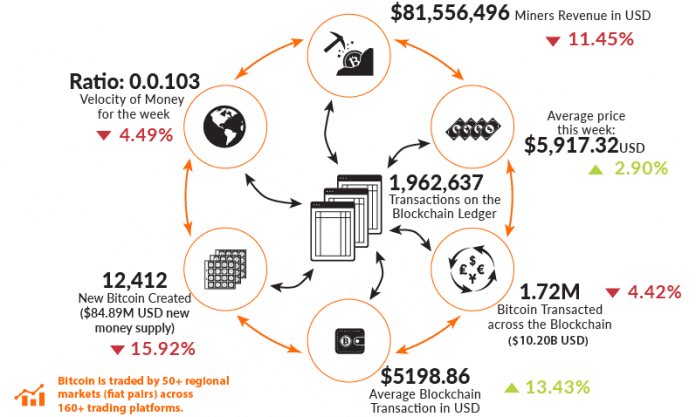

Bitcoin Mining

The process of mining brings in new coins into circulation and it is done by a subset of users or “miners”. You too can become a miner. But it requires computation resources and therefore electricity. Once in every ten minutes, like a lottery win, one miner gets lucky and is rewarded with a new Bitcoin. It began with 50 coins every ten minutes, but this number is lowered every four years. By the year 2140, the reward would be Zero. And then, the final number i.e 21 million coins would be in circulation and it would be a hard stop

![What is Bitcoin? [The Most Comprehensive Step-by-Step Guide]](https://www.henryharvin.com/blog/wp-content/uploads/2020/07/BlockReward-5c0ad88946e0fb0001af7198.png)

It’s one of Bitcoin’s more stylised design features, that miners while investing computational resources into mining provide a service to the network, they identify and approve of the transactions sent by users to each other. Miners merge all transactions on the network into blocks and the miner who is awarded the Bitcoin has to get his block and all transactions in it stamped approved by the network. Meaning if ever there are two conflicting entries( i.e if somebody tried to dupe the system and send the same bitcoin to two different users) only one of the transactions will get recognized as valid .

Every new block has its link to the previous block. The blocks form a blockchain. In a scenario where two miners find a new block simultaneously, the two different competing transaction histories will remain only for a short period. This resolution comes through a race, the first blockchain to establish linkage with another block will be accepted as valid by the entire network. So even if it takes time the Bitcoin networks always recognizes and validates a single version of the transaction history

Finally, it is remarkable to note, that users on the network don’t reveal themselves with their original names. Instead, they supplement it with Bitcoin addresses. These addresses are nothing but a lookalike of random strings of numbers and letters.

Who Invented Bitcoin?

Bitcoin was invented by Satoshi Nakamoto, (definitely) a pseudonym. To date, no one has been able to connect Satoshi Nakamoto a bitcoin millionaire to an actual person or group .

The world in November 2008 was first introduced to Satoshi Nakamoto’s proposal when he submitted a white paper that explained Bitcoin to a cryptography mailing list. In the following months, Satoshi Nakamoto published the software. Satoshi Nakamoto mined the first-ever Bitcoin block, also termed as the “genesis block”. This was done on January 3, 2009, setting the Bitcoin protocol in motion.

While the Bitcoin project in the early days saw his active involvement. However Satoshi Nakamoto disappeared in 2011, leaving few clues as to who he might be.

Speculations are rife about how many bitcoin Satoshi Nakamoto mined in the early days. Days when even the number of people who had even heard of Bitcoin was negligible. Estimates put it at from 50 to 1 million. Amazingly, even if some part of the estimate is to be believed, Satoshi Nakamoto seems to have touched very few, if any, of his coins.

Do Bitcoin Millionaires Control Bitcoin?

Certainly not the bitcoin millionaires. Bitcoin is not governed by any single manager or entity. Instead, it is maintained by a consortium of users. One of Bitcoin’s most dominant and unparalleled qualities is the fact that the transactions on its blockchain ledger are authenticated by the agreement in unison of the network’s members and not by “trusted” authority or a third party or.

So, no single authority or organization “controls” Bitcoin as in case of money where the government controls a fiat currency or a board that regulates a corporation. When users apply a full Bitcoin node to validate transactions and blocks on the blockchain, they specify the protocol that the node will use.

Ownership

- Just 4% of addresses own 96% of the bitcoin amount (containing 2.9 million BTC).

- 457,000: number of addresses or probable bitcoin millionaires grew rich by $10,000.

- 715,000: number of active addresses in the past 24 hours.

- $19 billion: combined total value of the 100 richest bitcoin millionaires.

- 500,000: number of Bitcoin.com wallets downloaded.

How to Get Bitcoin?

As explained earlier the process of minting a bitcoin is called mining and bitcoin can also be substituted as something acceptable in the trade. But the more easy way to own a Bitcoin is through purchasing it with a FIAT currency

- Bitcoin Exchanges

Most people buy bitcoin through online exchanges. And here it’s the users of the exchange, who determine the “price” of bitcoin relative to fiat currency through supply and demand. You typically need to use a debit card or direct bank account transfer for Buying bitcoin on an exchange.

- Over the Counter

Unlike buying on an exchange, an OTC desk double up as a middleman that consummates Bitcoin transactions without an order book — connecting buy and sell orders directly.

- Bitcoin ATMs

Bitcoin ATMs are kiosks are somewhat similar to traditional ATMs but connect users to the internet. These ATM lets them purchase bitcoin with fiat money. Some bitcoin ATMs permit users to sell bitcoin as well.

- In-Person

It is, also possible for you to buy bitcoin directly from someone who already owns bitcoin, in person. Many cities have Bitcoin meetups, where people might be willing to trade bitcoins. You also have websites on which buyers and sellers can link up with each other and meet up later for a trade.

To know more about acquiring and buying bitcoin, click here “How to Get Bitcoin”

How Do I Store Bitcoin?

After having answered how to buy Bitcoins you also need to know Bitcoin Millionaires store them. Of course, bitcoin is stored on Bitcoin addresses. They can be bitcoin utilised with “private keys”. Unique strings of numbers and letters are associated with these address. Therefore, one who owns the private key essentially owns the coins. Storing bitcoin means keeping the private keys. This can technically be done in any way your preference: on a USB drive, a piece of paper or you could even memorize it (but this is not advised).

Here are some of the more prevalent solutions for storing your bitcoin:

- Hardware Wallets

Hardware wallets are physical devices that encrypt the keys needed to spend bitcoin. Critically, these devices remain offline, and hence are hackerproof

- Software Wallets

Software wallets are pieces of software that you download and run on your digital device. Often much easy to use, they are also wired to the internet, which can make them somewhat vulnerable to advanced hackers.

- Paper Wallets

Paper wallets are physical pieces of paper with your Bitcoin address keys and therefore your bitcoin noted on it

Since paper wallets are relatively difficult to set up securely, their use is not recommended any longer.

![]() What decides Value of Bitcoin?

What decides Value of Bitcoin?

“Bitcoin is a remarkable cryptographic achievement and the ability to create something that is not duplicable in the digital world has enormous value.”

Eric Schmidt (Google -CEO)

The three Quintessential New-Age Currency Traits

In the digital age we live in, the ideal brand new currency should have at least these three basic traits.

- It should not be under the control of any authority, so that is manipulation, devaluation(printing at will) is restricted. Also, nobody should dictate terms of its usage to the people having it

- Borders of a country should not be a limiting factor for a currency. It should be free of restrictions about exchange across locations and with anyone

- It is bereft of political biases . This helps it prevent favouring a particular system or group of people. Its value primarily comes from the fact it being the first digital currency that no single person, organization, or authority has control over. Anyone can buy it, anyone can receive it — and nobody can tell anyone what they can or cannot do with it.

Traits that Increase Value of Bitcoin,

Dictatorship, oppression and hyperinflation cannot affect this money. It is a financial safe-haven for anyone facing these circumstances.

It comes with a limited supply capped at 21 million total bitcoins,that will never be altered. And we know exactly how many are in circulation in this world at what rate, as well as approximately when the last bitcoin will be created.

People living in first world countries may not be able to understand or support the notion of a decentralised currency being valuable. As their currency is pretty stable but then the people from the first world should realise that the FIAT money system is prone to weakness

The Problem With Fiat

Any money controlled by a central bank is, in fact, no sound when you delve into the big picture. Plainly speaking, governments have created monetary systems that permit them to manipulate the supply of their country’s money, asserting its value. They support it by their word that it will always be worth something as per the promise made. However the issue is that “something” has slowly been losing its value.

The reason behind this is: Governments want to spend more than they collect from taxes and other revenue sources; so, by the power vested in them, they mint enough money for their needs. When more money is circulated into an economy, it decreases the value of each unit already in circulation.

Bitcoin’s exquisitely crafted traits affect people’s lives in unstable economies (like Argentina and Venezuela,). The government in these countries heavily manipulates its money.

Economies like Venezuela and Argentina have witnessed times where their governments printed so much of their currency that their citizens could not spend it fast enough before it lost value. This has happened multiple times in each country and, as a result, their entire monetary systems fell apart, and affected citizens had to resort to an alternative medium of exchange.

Why Do We Use Fiat Money?

Our current monetary system is acceptable to people is because it’s what we have and it’s what we have had for as long as we can remember. Because people living today were born into the existing system of government-issued money. Society willingly accepted that the gradual increase in price for everything from groceries to education is a natural occurrence.

It is hard to believe that prices will continue to inch north forever. Tea may cost 50 Rs per cup in 50 years (compared to the 10 rs average today and the 1 rs it cost in 1990. We owe these increases to the natural result of inflation, which they correctly are. But the underlying reason why inflation occurs in the first place is due to the manipulations of a central authority.

Why Bitcoin Is Valuable?

Bitcoin is devoid of the core flaws that infest the fiat monetary system. All the user agree upon a code to lock the Supply of Bitcoin . Its always fixed and transparent Distribution rate at which the new bitcoins are circulated into the world . Even the estimated date when the last bitcoin will be created is fixed. Bitcoin is faceless and has no names attached that can strongly sway the direction of the currency. It’s the rectification of these flaws of our current system that bring value to bitcoin.

So the answers lie in here for reveal value to touching millions soon and there will plenty of Bitcoin Millionaires soon

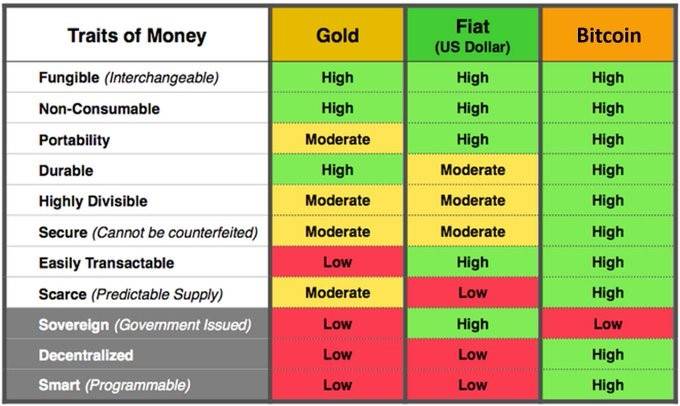

Bitcoin Is The Best Form Of Money In Existence:

To understand, let’s put gold, fiat, and Bitcoin in juxtaposition. All are highly interchangeable and non-consumable. Only gold and Bitcoin have high durability. Divisibility and security for Gold and FIAT are moderate, while Bitcoin beats them on the two qualities. The predictability of supply for gold is moderate while for fiat it is low. Bitcoin has a high predictability.

Bitcoin Halving Will Propel The Price In The Right Direction

Forbes recently had an article saying “Why The Bitcoin Price Could Hit $50,000 In 2020 by Kyle Torpey. He goes on explaining

While the Bitcoin price was on the downward rally for the second half of 2019, the fact is the crypto asset still roughly doubled in value during the year. So much so, there were only two major cryptocurrencies that surged ahead of Bitcoin in 2019.

Nexo co-founder Antoni Trenchev told Bloomberg’s, Matt Miller. Why he is of opinion that the Bitcoin price could continue its rise to touch $50,000 mark in 2020.

“I think that, very easily, we could see Bitcoin touching the $50,000 mark by the end of this year,”

Trenchev.

According to Nexo’s researchers and analysts, the upcoming halving event would lead to a massive rise in the Bitcoin price. A halving event in Bitcoin is when the amount of Bitcoin generated by the network every ten minutes is halved. This event takes place every four years.

“The last time halving brought, Bitcoin brought a rally of 4,000%,” noted Trenchev.

Trenchev also pointed out that Bitcoin is mostly not having its ties to the rest of the market. And hence it is providing awry returns for holders of the cryptocurrency.

Trenchev further claimed the main selling point of Bitcoin has evolved over the years.

Bitcoin and its chronology

- October 31, 2008: Anonymous Satoshi Nakamoto publishes Bitcoin whitepaper

- January 3, 2009: Mining of Block number one or Genesis Block

- January 12, 2009: First Bitcoin transaction noted

- December 16, 2009: Launch of Version 0.2.

- November 6, 2010: Market cap value exceeds USD 1 million.

- October 2011: Litecoin created. Bitcoin forks for the first time.

- June 3, 2012: 1322 transactions create Block 181919. It is the largest block to-date.

- June 2012: Coinbase launches.

- September 27, 2012: Bitcoin Foundation comes into existence.

- 4th December 2013: Price touch a high of $1,079.

- 7th December 2013: Price nosedive to around $760.

- February 7, 2014: Hacking of Mt. Gox .

- June 2015: BitLicense comes into origin. A significant cryptocurrency regulation.

- August 1, 2017: Bitcoin forks once more Bitcoin Cash comes into existence.

- August 23, 2017: SegWit gets activation.

- September 2017: China bans BTC trading.

- December 2017: CBOE Global Markets and the Chicago Mercantile Exchange (CME) launches First bitcoin futures contracts.

- December 2017: Bitcoin price climbs all-time high.

- January 2018: 2018 cryptocurrency market crash leading to the price drop.

- September 2018: 80% collapse in Cryptocurrency value from their peak in January 2018,

- November 15, 2018: Bitcoin’s market cap falls beyond $100 billion for the first time

- October 31, 2018: Bitcoin observes 10th anniversary

- May 11, 2020: 3rd Bitcoin halving

. “Bitcoin is a very exciting development, it might lead to a world currency. I think over the next decade it will grow to become one of the most important ways to pay for things and transfer assets.”

Kim Dotcom (CEO of MegaUpload

Is Bitcoin a Good Investment?

And finally, after all this sequencing, there remains a lot to know about bitcoin. But those seeking advice on Bitcoin as an investment option the Bitcoin has two side

Some envisaging a fully-distributed future in which no role-play of a centralized overseer becomes key to an asset’s value will assert, yes, bitcoins are slated to become only more valuable in the future. Others who believe in the traditional trust projected and offered by banks and government institutions would likely to guard you against taking bitcoins as an investment.

While concluding as to how “good” any investment will be is ultimately a matter of guessing. However, there are some tried and true ways to measure an asset’s worth

Furthermore, a fundamentally supportive concept behind Bitcoin is that there will only ever be 21,000,000 tokens. Which means that it may stay consistently valuable or increase in value relative to other types of currency which can be printed endlessly. Also why Bitcoin seems like a good investment is because it is supported by its

- rising popularity,

- network effects,

- & security, immutability and status as the first-ever in a growing world of digital currencies.

FAQS

How did Bitcoin get value?

Trust and adoption are the attributes that make money to hold value. With its growing base of users, merchants, and start-ups stand testimony to Bitcoin acquiring those two attributes. And unlike any other currency Bitcoin to has started holding value because people have started showing acceptance for it

Other Henry Harvin Courses:

Are Physical Bitcoins worth anything?

The value of The physical Bitcoins(Casascius) from the year 2011 -2013 . There are reports of one single Casascius series selling for a price beyond the coin’s face value. The digital form of Bitcoin at loses out Physical Bitcoins when it comes to holding a collectable value

Why you should not buy Bitcoin?

The plausible reason why one should not buy Bitcoins because the risk exposure is way too high. The fluctuation in price especially the downward spiral is as high as 80%. Moreover, it’s not a one-off incident it has happened thrice but the good part is the recovery and newer heights

How can you tell if a Bitcoin is real?

Bitcoin cannot be faked and is tamperproof. Its origin and existence lies in encrypted calculations done on the Blockchain data. Your wallet reads into Blockchain and confirms the number of Bitcoins you have. Upon receiving the confirmation from blockchain the Bitcoins enter your wallet and exit from the originating wallet.

![10 Reasons Why Crypto-Currencies Are Banned in 2024 [Updated] Why Crypto-Currencies Are Banned](https://hh-certificates.sgp1.digitaloceanspaces.com/blog/wp-content/uploads/2020/07/19124339/pasted-image-0-88-270x180.jpg)

![Uses Of Bitcoin In Gambling in 2024 [Updated]](https://hh-certificates.sgp1.digitaloceanspaces.com/blog/wp-content/uploads/2020/07/19124600/pasted-image-0-91-270x180.jpg)

![10 Amazing Facts About Legality of Bitcoin Trading in India in 2024 [Updated]](https://hh-certificates.sgp1.digitaloceanspaces.com/blog/wp-content/uploads/2020/05/10105703/pasted-image-0-14-270x180.jpg)

![8 Scams You Can Miss: The Rise And Rise Of Bitcoins 2024 [Updated]](https://hh-certificates.sgp1.digitaloceanspaces.com/blog/wp-content/uploads/2020/07/17113132/pasted-image-0-74-270x180.jpg)

![10 Courses To Know How Bitcoin Works in 2024 [Updated] How Bitcoin Works](https://hh-certificates.sgp1.digitaloceanspaces.com/blog/wp-content/uploads/2020/08/15102809/pasted-image-0-62-270x180.jpg)

.webp)