Table of Contents

Data Science creates meaningful information in large volumes to big data. Data Science gives scientific, creative, and investigative thinking to big data. Data is drawn from several resources, channels, and platforms like surveys on phones, emails, social media, e-commerce sites, etc.

The goal of Data Science is not to execute but to learn and develop new business capabilities. Data Science applications are useful when the data is a vital resource and can solve a query by giving correct and accurate information.

E&ICT IIT Guwahati Best Data Science Program

Data Science Course - Guaranteed Internship at E&ICT IIT Guwahati Campus

Mentored By Chetan Bhagat

$99 FREE

Access Expires in 24Hrs

Similarly, Data science techniques play a crucial role in detecting and analyzing various risks involved in any SOPs to be followed in the organization. In addition, the risk involved in accessing vital information, secure information, personal information, any banking or financial information, or online transactions.

Check out Henry Harvin’s Data Science Course for learning basic as well as advanced data science techniques, tools, and methodology to handle large complex data and provide useful information that can be used as a powerful resource in various processes, SOPs, and applications.

Henry Harvin is a leading Data science institute that provides Advanced Data Science Courses to upskill your technical skills and become a useful resource to any organization. You can learn, how to implement Data Science Techniques for risk management in applications, online processes, and transactions. In addition, Henty Harvin in collaboration with E&ICT Academy, and IIT Guwahati, also provides various online courses in disciplines like Data Science, Digital Marketing, SAP, HR analytics, and more. Here is the list of Data Science Courses by E&ICT Academy, IIT Guwahati, such as:

- Basic Certification Course in Data Science with Python by E&ICT Academy, IIT Guwahati

- Advanced Certificate Program in Data Science & AI by E&ICT Academy, IIT Guwahati

After successful completion of the course, candidates avail the benefits of achieving a Dual Certificate for the applied Data Science Course one from Henry Harvin and another from E&ICT Academy, IIT Guwahati.

Data Science creates meaningful information in large volumes to big data. Data Science gives scientific, creative, and investigative thinking to big data. Data is drawn from several resources, channels, and platforms like surveys on phones, emails, social media, e-commerce sites, etc.

However, it takes time for any new technology to be adopted and proved to be beneficial to the organization. Data Science techniques are result-oriented and have proven useful in various applications such as risk management, data analysis, and smooth SOPs in industry or automated access to data that is unique and provides useful information in various processes and applications.

“If only you knew what question to ask me, I would give you some fascinating answers based on the data.”

Check out Henry Harvin’s Data Science Professional Courses

Such a capability is powerful since we often do not know what question to ask.

It takes time for any new technology to be adopted by the economy and produce benefits to the Organization.

Data Science is the most recent wave with upgraded technology in today’s scenario. A study shows that an increase in profit and return on investment in data science is increasing day by day.

Effective Data Science Techniques for Risk Management

Data Science Techniques are highly effective in risk management across various industries due to their ability to analyze large volumes of data, data correction, and accuracy, identify patterns, and predict potential risks.

- Data Collection: Data science relies on the collection of large amounts of data from various sources.

- Data Cleaning and Preprocessing: Once collected, the data often needs to be cleaned and preprocessed to ensure accuracy and consistency.

- Exploratory Data Analysis (EDA): EDA involves visually exploring the data to understand its characteristics, and identify trends, patterns, and correlations.

- Predictive Modeling: Data science techniques such as machine learning algorithms are used to build predictive models that can forecast future risks based on historical data.

- Risk Assessment: By analyzing data, and trending patterns, you can use predictive risk models to assess the potential risks.

- Continuous Monitoring and Adaptation: Risk management is an ongoing process, and data science techniques facilitate continuous monitoring of risks and their mitigation measures.

Data Science Techniques are powerful tools for identifying, assessing, and mitigating risks in various domains. Applying data sciences enables organizations to maintain accuracy, make justified decisions, and minimize potential losses.

Companies apply data science to everyday activities to bring value to their customers. Most industries, such as banking institutions, are counting on data science for fraud detection successes. Companies like Netflix also use algorithms to analyze what to deliver to their users. Even advertisements on IRCTC websites are as per user interests taking a cue from the previous browsing history of the user, thus by using data available on the user’s computer system.

Data Science is evolving, and its application will continue to bring change. Data science may save money and improve the business process’s efficiency, but these technologies can also destroy business value. The risk of inability to identify and manage data can lead some managers to delay the adoption of the techniques and thus prevent them from realizing their full potential.

Data Science in risk management has always been a matter of measuring; it quantifies the frequency of loss and multiplies it by the severity of the damage. Any forward-thinking organization asses and tracks its risk factors and tackles complex challenges using Data Science as it provides analytical tools.

Looking forward to becoming a Data Scientist? Check out the Data Science Bootcamp Program and get certified today.

10 Applications of DATA Science to reduce risk and provide quick and smooth processing in various domains are mentioned below:

- Fraud and Risk Detection

- Healthcare

- Internet Search

- Targeted Advertising

- Road Travel

- Government

- Website Recommendations

- Advanced Image Recognition

- Speech Recognition

- Gaming

1. Fraud and Risk Detection: Data Science Courses for Risk Analysis

The earliest application of Data Science was in finance. Data Science was brought to rescue the organizations from losses. It helped them segment the customers based on past expenditures, current credits, and other essential variables to analyze the probability of risk and default. It also enabled them to push their financial products based on customer’s financials.

2. Healthcare: Role of Data Science in Healthcare Risk Management

The Healthcare database of individuals who have been using the healthcare system for a long time helps identify and predict disease and personalized healthcare recommendations. E.g., some individuals are diagnosed with diabetes, and a subset has developed complications. Data Science becomes useful in drawing patterns of the complexities and probability of the complications, therefore, taking the necessary precautionary steps.

3. Targeted Advertising: Best Data Science Courses for Risk Management

Digital advertisement gets higher click-through ratings rather than traditional endorsements. It is targeted based on users’ previous behavior. Automating digital ad placement is why the wife sees an apparel advertisement, and the husband sees a real estate deal advertisement at the same place and time.

4. Internet Search: Best Data Analytics Courses for Risk Analysis

We have many search engines such as Yahoo, Bing, Ask, AOL, and Google. All these search engines use data science algorithms to deliver the best results, and it is their responsibility to verify the resources and achieve the correct result.

5. Website Recommendations: Data Science and Risk Management

E-commerce provides a personalized digital mall to everyone. Using data science, Companies have become intelligent enough to push and sell products as per customers’ purchasing power and interest through previous product searches. On Amazon, we get suggestions about similar products that we had earlier searched.

6. Road Travel: Data Science Implementation

A perfect example is Google Maps, in which Google uses the road map data to update the app. The biggest challenge is to keep the plan updated on a real-time basis as it has to be updated as per the traffic in the particular area as well as any ongoing construction, roadblocks, bad weather, etc. with an alternative route.

7. Government: Top Data Science Courses for Risk Detection and Management

The government maintains the records of the citizens in their database, including photographs, fingerprints, addresses, phone numbers, etc., to maintain law and order in the country. This data helps the government in taxation, passing on financial benefits to the needy, and even tracking down lost people.

8. Advanced Image Recognition: Data Science Techniques for Risk Management

When we upload an image on Facebook, we get suggestions to tag friends. These automatic suggestions use a face recognition algorithm. Apple uses the same kind of software to segregate photos from the photo gallery. The online payment app uses a QR code to make the payments successful.

9. Speech Recognition: Advanced Data Science Techniques for Risk Management

The best examples of speech recognition products are Siri, Alexa, Google Voice, Cortana, etc. Nowadays, it is an added feature in almost every electronic product that uses a graphical user interface to take commands from its users. Speech recognition is being used to type messages on practically every message-sharing application.

10. Gaming: Data Analysis for Risk Management

Electronic games are designed using machine learning algorithms, which improve and upgrade themselves as the player moves up to the next level. In motion gaming, too the opponent (computer) analyses previous moves and accordingly shapes the games.

Instagram for photo sharing and marketing, Facebook for socializing, i.e., making friends, Linkedin for professional collaboration, and Tinder for dating are some examples of everyday applications/websites that use algorithms to match user interests and provide them a wholesome entertainment.

In older days, shopkeepers also used to collect data; however, the use was on a lower scale. As we know, the customer is king the shopkeeper used to observe the pattern of purchase in that particular locality and then fill his shop as per the requirement.

For new things that were to be introduced as there was risk associated with uncertainty, the goods were just bought in samples, and if accepted by the public, more of the order was placed. The same is the case with data science in risk management.

Data Science in Risk Management

Risk Management is the identification of risk in advance and taking precautionary measures to reduce or mitigate the risk. Risk can be physical or financial, and an assessment is needed to evaluate each risk and decide which ones to manage. Earlier risk management was done mainly through insurance.

The use of Data Science in risk management has several benefits. Risk managers have to work closely with their IT department to use these tools to provide risk-reward analysis, effectively. To use data science and machine learning, the intervention of persons running the business is required as they are the one who knows what is being calculated, while IT persons just make that happen.

Using Data Science to evaluate risks is a cross-disciplinary task. For a complete analysis, it is necessary to have good knowledge about the domain, excellent mathematics and statistics skills, and an innovative approach to problem-solving.

The Economist lists the types of risks of the industry as follows:-

- Retail banks worry about credit risk;

- Commercial banks focus on market risk;

- Investment banks are most concerned about operational risk.

- Data is the new science. Big Data holds the answers- ARUJANT

Large volumes of data are generated from transactions, as online shopping or Banking transactions are increasing day by day.

Credit Risk (Predictive Power)

Data science can be used to build predictive models related to future demand and supply. Social media and marketing data and data from every type of transaction will give deeper visibility of customer behavior. The occurrence of fraud is a rare scenario as compared to the number of transactions taking place. It requires a large number of data points for an accurate model.

Operational Risk Fraud Management

Data Science is used to create an efficient system to detect and prevent fraudulent activities and regulatory breaches. Traditional methods are slow and require a case-by-case study to detect fraud. The new technology of data science analyses data and the standard data to detect fraud before it becomes a scandal. Data Science and machine learning make organizations Legally defensible, especially in fraud cases, as it allows them to collect and access DATA easily. However, it should be supported by the collection purpose and that it’s not tampered with along with generation policy.

Qualitative Risk Management

Data Science calculates risk probability and impact assessment of the risk, and also the cost to business. The probability and impact matrix indicates which risk needs to be managed. Assessment of risk is generally done under qualitative analysis.

Quantitative Risk Management

It covers the impact of risk on a business or project in numbers. This numerical information project risk analysis as per time and cost contingencies.

Data Science Applications for Risk Management

Data science finds numerous applications in risk management across various industries. Here are some key applications:

- Credit Risk Assessment: Data science techniques are widely used in banking and finance for assessing credit risk.

- Insurance Underwriting: Insurers leverage data science to assess risk factors associated with insurance policies.

- Market Risk Management: In investment and trading, data science techniques are applied to manage market risk.

- Operational Risk Management: Data science helps organizations identify and mitigate operational risks related to internal processes, systems, and human factors.

- Cybersecurity Risk Management: Data science techniques are employed to detect and mitigate cybersecurity risks, including threats such as malware, phishing attacks, and data breaches.

- Supply Chain Risk Management: Organizations use data science to manage risks in their supply chains, including disruptions due to natural disasters, geopolitical events, or supplier failures.

- Healthcare Risk Management: Data science contributes to healthcare risk management by predicting patient outcomes, identifying potential medical errors, and optimizing resource allocation.

- Compliance and Regulatory Risk Management: Data science helps organizations ensure compliance with regulatory requirements and mitigate risks associated with non-compliance.

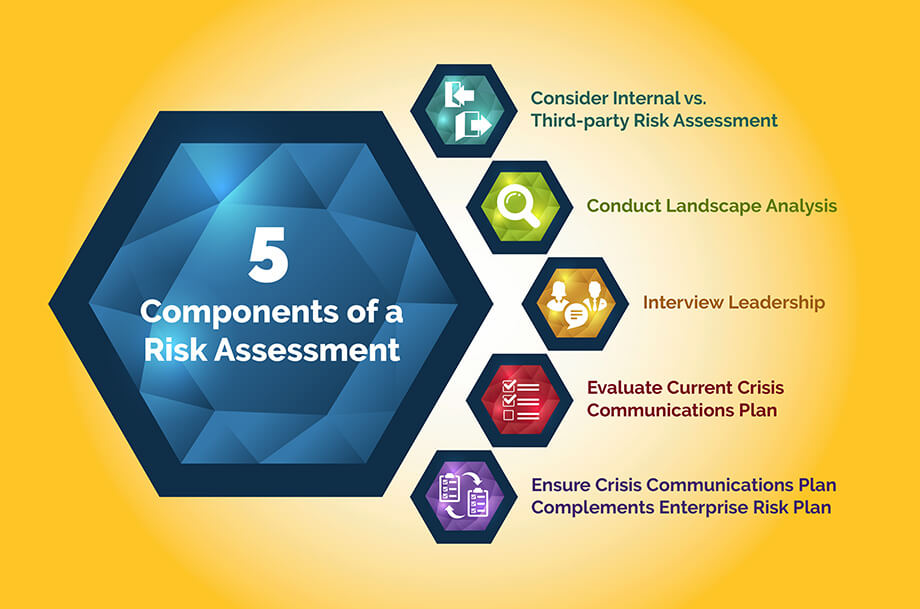

Risk Analysis Comprises the Following components:-

1. Reporting

Information for management and regulators from specific views of data. It is used to generate different unidentified scenarios for the business. It is based on their experience or intuition. It also includes analyzing the current process and making decisions on new improvements. Various surveys checklist questionnaires and interviews are conducted to gather their perspective. There is a what-if technique used by the expert to instigate questions to identify risk. Fault tree analysis is also a technique used by a data scientist to manage risk and project risk analysis. It is the reverse brainstorming method, e.g., if our objective is to improve customer service, state the aim in reverse as to how can we annoy the customers. Data points are generated for such cases, and algorithms are adjusted as per requirements.

2. Risk Analysis

Components or Factors that affect accelerate the drivers of risk. It includes the translation of the above-created scenarios through environmental parameters through macroeconomic quantification and assessing their impact on the market and business and the P&L.

3. Model and Optimization

Pricing of risk, forecasting risk, and preparation to mitigate risk. And translate them through environmental parameters through macroeconomic qualification and assessing their impact on the market and business and the P&L.

4. Monitoring and Alerting

Triggers and alerts on specific data points to track risk and exposures. Risk response planning and risk mitigation strategies are created, and preventive, and contingency plans are set up.

5. Responding

It is the action to be taken basis the analysis, designing the response, and monitoring outcomes. In case of any risk identification, automated responses are given for low-impacting or frequent events, while manual intervention is considered in other cases.

Impact of Data Science on Risk Management

- Empowers management and officers to make a better decision

- Directs the actions based on trends, which helps in defining goals.

- Challenges the staff to adopt best practices and focus on the issues that matter.

- Identifies opportunities

- Decision-making is quantifiable data-driven evidence.

- Testing decisions

- Identification and refining the target audience.

- Recruiting the right talent for the Organisation

How to Manage Risk Through Data Science

Domain specialization

The next generation of Analytics will rely heavily on domain specialization, thus delivering solutions for target industry sectors.

Automation of analytic processes

Analytics processes like Data Preparation or Data Modeling will become automated in most cases. The learning algorithms of ML-powered, AI solutions will provide quicker and better results over time.

Multi-Skilled Data Scientist

In addition to being highly skilled in their fields, future Data Scientists have to be knowledgeable in industry domains to succeed in their jobs. Without adequate domain knowledge, future Data Scientists will not quickly translate a business problem into Data Science. This implies that they should have a basic understanding of the domain.

Predictive Analytics will Require Different Skills for Different Industries

Predictive Analytics is becoming so specialized and divergent across industry sectors that the ultimate Predictive Analytics tools and features will be tuned for industry-specific applications.

Citizen Scientists will Perform Sophisticated Analytics:

Analytics platforms will become so well-equipped that Citizen Data Scientists will be able to execute Advanced Analytics tasks without the help of experts.

Deep Learning will be Simplified and Operationalized:

requires more simplification for full adoption into Business Analytics platforms. DL techniques hold groundbreaking promise for significant forensic science applications through highly accurate facial recognition, and the wide adoption of this technology into Analytics platforms will be a game-changer for the Business Analytics solution provider market.

Adaption of Data Science in Management

Managers need not be data scientists. They have to understand the fundamental principle to be able to provide the appropriate resources to data science teams. They have to have a clear vision of the implications of these projects and be willing to tackle risks in investing in data science. Managers need to ask questions to data scientists as they often get muddled up in technical jargon.

Data science spans so much of the business that a diverse team is essential. Just as we can’t expect a manager necessarily to have in-depth knowledge of data science, we can’t expect a data scientist necessarily to have deep expertise in business solutions.

However, for a data science team to be capable, there needs to be a close collaboration between the two fronts with at least a basic understanding of each other’s respective fields. A solid grounding in the fundamentals backs the far-reaching strategic implications of data science.

We know of no systematic scientific study, but broad experience has shown that as executives, managers, and investors increase their involvement in data science projects, they see more and more opportunities in turn.

Recommended Reads:

- Top 15 Best Data Science Courses in Mumbai

- Top 10 Data Science Courses in Pune

- Top 10 Data Science Courses in Bangalore

- Top 10 Data Science Courses in Nagpur

- Top 20 Data Science Courses in Delhi NCR

- Top 10 Data Science Courses in India

Also, Check this Video

The irony is Human has created machines, and now these machines are used to hire humans for the job.

E&ICT IIT Guwahati Best Data Science Program

Ranks Amongst Top #5 Upskilling Courses of all time in 2021 by India Today

View Course

Recommended Programs

Data Science Course

With Training

The Data Science Course from Henry Harvin equips students and Data Analysts with the most essential skills needed to apply data science in any number of real-world contexts. It blends theory, computation, and application in a most easy-to-understand and practical way.

Artificial Intelligence Certification

With Training

Become a skilled AI Expert | Master the most demanding tech-dexterity | Accelerate your career with trending certification course | Develop skills in AI & ML technologies.

Certified Industry 4.0 Specialist

Certification Course

Introduced by German Government | Industry 4.0 is the revolution in Industrial Manufacturing | Powered by Robotics, Artificial Intelligence, and CPS | Suitable for Aspirants from all backgrounds

RPA using UiPath With

Training & Certification

No. 2 Ranked RPA using UI Path Course in India | Trained 6,520+ Participants | Learn to implement RPA solutions in your organization | Master RPA key concepts for designing processes and performing complex image and text automation

Certified Machine Learning

Practitioner (CMLP)

No. 1 Ranked Machine Learning Practitioner Course in India | Trained 4,535+ Participants | Get Exposure to 10+ projects

Explore Popular Category

.webp)